When Must I Register As An Investment Advisor Massachusetts

What is Foreign Direct Investment (FDI)?

Foreign directly investment (FDI) is an investment from a political party in one country into a business concern or corporation in another state with the intention of establishing a lasting interest. Lasting interest differentiates FDI from foreign portfolio investments, where investors passively hold securities from a foreign state. A foreign direct investment can be made by obtaining a lasting interest or by expanding one'south business into a foreign country.

Lasting Involvement and the Element of Control

An investment into a foreign firm is considered an FDI if information technology establishes a lasting interest. A lasting interest is established when an investor obtains at least 10% of the voting ability in a house.

The key to foreign direct investment is the element of control. Control represents the intent to actively manage and influence a strange house's operations. This is the major differentiating factor between FDI and a passive foreign portfolio investment.

For this reason, a 10% stake in the foreign company's voting stock is necessary to define FDI. Withal, there are cases where this criterion is not ever practical. For example, it is possible to exert control over more widely traded firms despite owning a smaller percentage of voting stock.

Methods of Foreign Direct Investment

As mentioned above, an investor tin can make a strange direct investment by expanding their business in a strange state. Amazon opening a new headquarters in Vancouver, Canada would exist an example of this.

Reinvesting profits from overseas operations, too equally intra-company loans to overseas subsidiaries , are besides considered foreign directly investments.

Finally, there are multiple methods for a domestic investor to acquire voting ability in a foreign visitor. Beneath are some examples:

- Acquiring voting stock in a strange company

- Mergers and acquisitions

- Joint ventures with foreign corporations

- Starting a subsidiary of a domestic business firm in a foreign state

Learn more about mergers and acquisitions with CFI's mergers & acquisitions (M&A) modeling course!

Benefits of Foreign Direct Investment

Foreign direct investment offers advantages to both the investor and the strange host country. These incentives encourage both parties to engage in and allow FDI.

Beneath are some of the benefits for businesses:

- Market diversification

- Tax incentives

- Lower labor costs

- Preferential tariffs

- Subsidies

The following are some of the benefits for the host land:

- Economic stimulation

- Development of human capital

- Increment in employment

- Access to management expertise, skills, and technology

For businesses, almost of these benefits are based on cost-cutting and lowering risk. For host countries, the benefits are mainly economic.

Disadvantages of Foreign Directly Investment

Despite many benefits, there are still two master disadvantages to FDI, such equally:

- Displacement of local businesses

- Turn a profit repatriation

The entry of big firms, such every bit Walmart, may displace local businesses. Walmart is often criticized for driving out local businesses that cannot compete with its lower prices.

In the case of profit repatriation, the primary concern is that firms volition not reinvest profits back into the host state. This leads to large capital outflows from the host country.

As a effect, many countries accept regulations limiting foreign direct investment.

Types and Examples of Strange Direct Investment

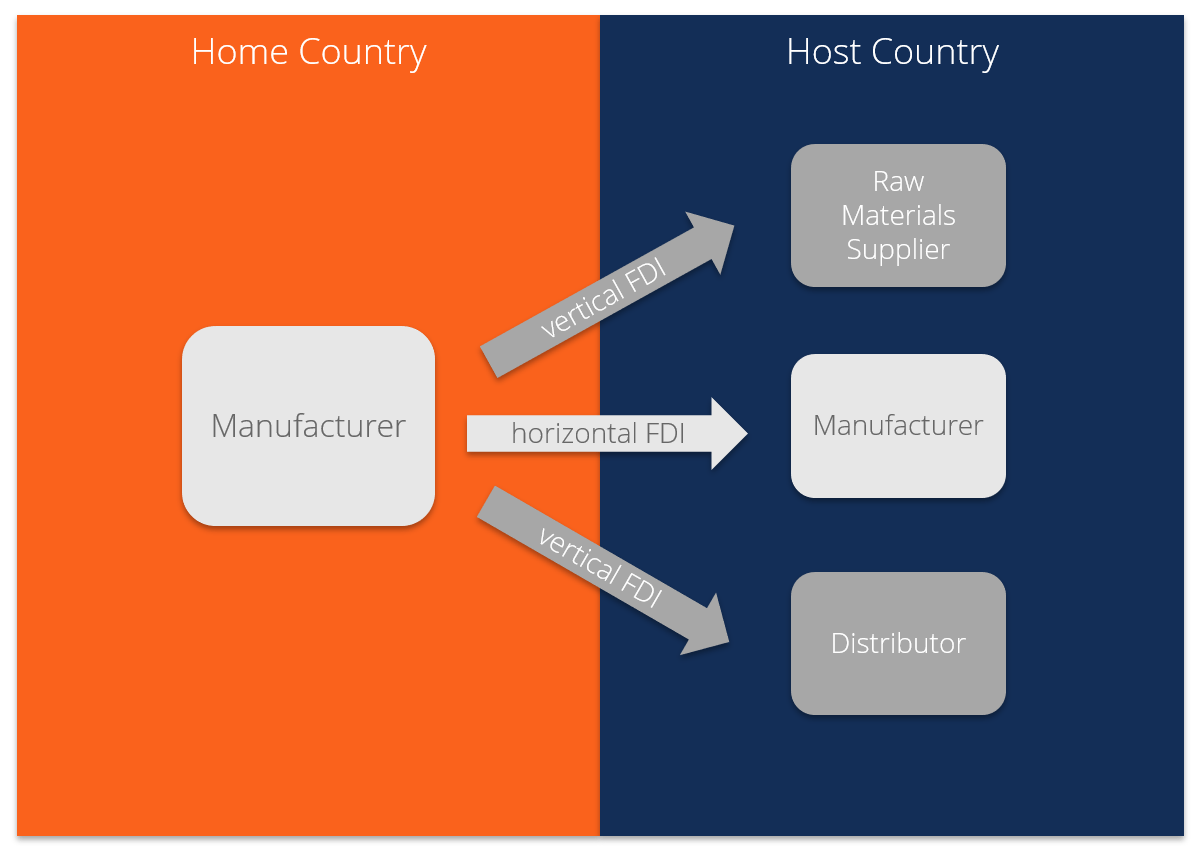

Typically, there are 2 main types of FDI: horizontal and vertical FDI.

Horizontal:a business expands its domestic operations to a foreign country. In this case, the business conducts the aforementioned activities merely in a foreign country. For instance, McDonald'southward opening restaurants in Japan would exist considered horizontal FDI.

Vertical:a business expands into a foreign country by moving to a different level of the supply chain . In other words, a firm conducts dissimilar activities away but these activities are still related to the main business. Using the same example, McDonald's could purchase a large-scale subcontract in Canada to produce meat for their restaurants.

However, two other forms of FDI accept as well been observed: conglomerate and platform FDI.

Conglomerate:a concern acquires an unrelated concern in a strange country. This is uncommon, as information technology requires overcoming ii barriers to entry: entering a strange country and entering a new industry or market. An instance of this would be if Virgin Group, which is based in the United Kingdom, caused a clothing line in France.

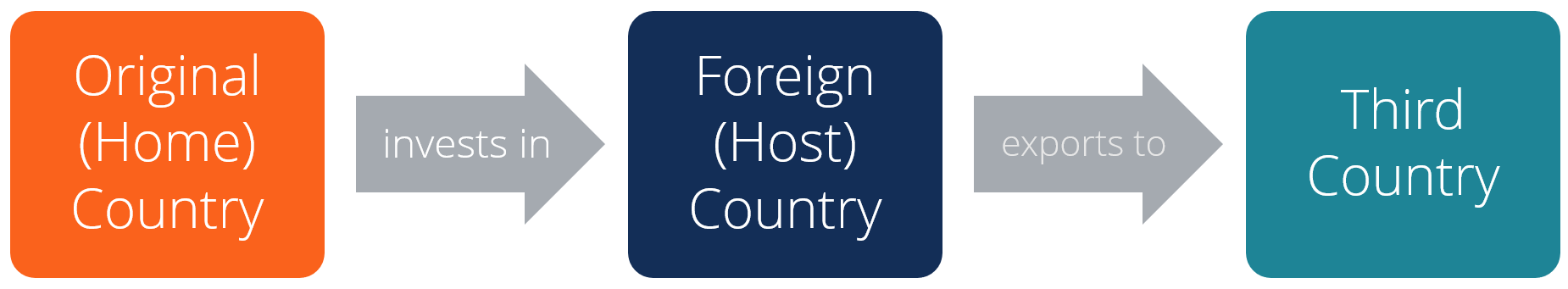

Platform:a business concern expands into a foreign country merely the output from the strange operations is exported to a third country. This is also referred to equally consign-platform FDI. Platform FDI commonly happens in depression-cost locations inside gratuitous-trade areas. For instance, if Ford purchased manufacturing plants in Ireland with the primary purpose of exporting cars to other countries in the Eu.

Boosted Resource

CFI offers the Financial Modeling & Valuation Analyst (FMVA)® certification plan for those looking to take their careers to the adjacent level. To keep learning and advancing your career, the following resources will be helpful:

- Fiscal Analysis Fundamentals

- Mergers & Acquisitions (One thousand&A) Modeling

- Corporate and Business organization Strategy

- Financial Policy

Source: https://corporatefinanceinstitute.com/resources/knowledge/economics/foreign-direct-investment-fdi/

Posted by: simmonsselven.blogspot.com

0 Response to "When Must I Register As An Investment Advisor Massachusetts"

Post a Comment